Pin Bar Candlestick Reversal Trading Strategy

An Introduction To The Pin Bar Forex Trading Strategy and How to Trade It Effectively…

The pin bar formation is a price action reversal pattern that shows that a certain level or price point in the market was rejected. Once familiarized with the pin bar formation, it is apparent from looking at any price chart just how profitable this pattern can be. Let’s go over exactly what a pin bar formation is and how you can take advantage of the pin bar strategy in the context of varying market conditions.

What is a Pin Bar?

The actual pin bar itself is a bar with a long upper or lower “tail”, “wick” or “shadow” and a much smaller “body” or “real body”, you can find pin bars on any stripped-down, “naked” bar chart or candlestick chart. We use candlestick charts because they show the price action the clearest and are the most popular charts among professional traders. Many traders prefer the candlestick version over standard bar charts because it is generally regarded as a better visual representation of price action.

Characteristics of the Pin Bar Formation

• The pin bar should have a long upper or lower tail…the tail is also sometimes called the “wick” or the “shadow”…they all mean the same thing. It’s the “pointy” part of the pin bar that literally looks like a “tail” and that shows rejection or false break of a level.

• The area between the open and close of the pin bar is called the “body” or “real body”. It is typically colored white or another light color when the close was higher than the open and black or another dark color when the close was lower than the open.

• The open and close of the pin bar should be very close together or equal (same price), the closer the better.

• The open and close of the pin bar are near one end of the bar, the closer to the end the better.

• The shadow or tail of the pin bar sticks out (protrudes) from the surrounding price bars, the longer the tail of the pin bar the better.

• A general “rule of thumb” is that you want to see the pin bar tail be two/thirds the total pin bar length or more and the rest of the pin bar should be one/third the total pin bar length or less.

• The end opposite the tail is sometimes referred to as the “nose”

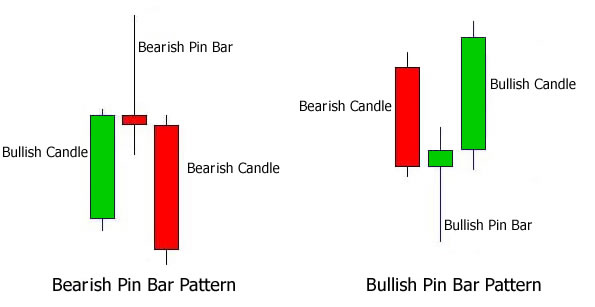

Bullish Reversal Pin Bar Formation

In a bullish pin bar reversal setup, the pin bar’s tail points down because it shows rejection of lower prices or a level of support. This setup very often leads to a rise in price.

Bearish Reversal Pin Bar Formation

In a bearish pin bar reversal setup, the pin bar’s tail points up because it shows rejection of higher prices or a level of resistance. This setup very often leads to a drop in price.

The pin bar is a staple of the way to trade the Forex market. It has a very high accuracy rate in trending markets and especially when occurring at a confluent level. Pin bars occurring at important support and resistance levels are generally very accurate setups. Pin bars can be taken counter trend as well, as long as they are very well defined and protrude significantly from the surrounding price bars, indicating a strong rejection has occurred, and preferably only on the daily chart time frame.

In the following chart example we will take a look at pin bars occurring within the context of a trending market; my favorite way to trade them. Also, note that this uptrend began on the back of two bullish pin bars that brought an end to the existing downtrend.

Other names you might find pin bars described by:

There are several different names used in ‘classic’ Japanese candlestick patterns that refer to what are basically all pin bars, the terminology is just a little different. The following all qualify as pin bars and can be traded as I’ve described above:

• A bearish reversal or top reversal pin bar formation can be called a “long wicked inverted hammer”, “long wicked doji”, “long wicked gravestone”, or “shooting star”.

• A bullish reversal or bottom reversal pin bar formation can be called a “long wicked hammer”, “long wicked doji”, or “long wicked dragonfly”.

Facts About Trading Forex with Pin Bar Reversal Strategy

Pin bars are one of the most popular of my price action trading strategies. They show a clear rejection of a price level and are often followed by a large directional move opposite the direction of the rejection. However, it takes a skilled and discerning eye to find high-probability pin bar setups that are worth risking your hard-earned money on. Thus, you will need to learn what a valid pin bar setup looks like, as well as when and how to trade them. Like anything else in life, pin bar trading takes education and then practice, so let’s get started by learning some facts about pin bar trading:

Pin Bar Fact: A Pin Bar is “NOT” a hanging man or doji candle. It’s a unique candle which shows rejection of a level via an obvious spike, or tail, much larger than the entire body. It’s only a valid pin bar “setup” if it forms in the correct place, otherwise, its nothing to take notice of. In other words, just because a candlestick has the form of a pin bar does mean it’s a trade-worthy pin bar signal.

Pin Bar Fact: We want to trade a pin bar in the opposite direction the spiky tail (also known as the shadow) is pointing. So, a bullish rejection pin bar is one that rejects lower prices and thus tips off to take a long position or buy the market, while a bearish rejection pin bar is one that rejects higher prices and thus tips us off to take a short position or sell the market.

Pin Bar Fact: Trading the pin bar strategy on higher time frame charts like the 4 hour and daily time frame, is a much higher probability way to trade them than trading them on the 5 minute or other low time frame charts.

Pin Bar Fact: We don’t just trade any old pin bar, because not all pin bars are created equal. We want to trade pin bars that form at swing lows in an uptrend or at swing highs in a downtrend. Ideally, we want to see a pin bar make a rejection or a “false-break” of a key level. Essentially, we want to trade pin bars with confluence, or at high-probability levels in the market.

Now that you know some solid facts about Forex pin bar trading you can watch the pin bar video below for a great explanation on how to trade them.

In Summary

The pin bar formation is a very valuable tool in your arsenal of Forex price action trading strategies. The best pin bar strategies occur with a confluence of signals such as support and resistance levels, dominant trend confirmation, or other ‘confirming’ factors. Look for well formed pin bar setups that meet all the characteristics listed in this tutorial and don’t take any that you don’t feel particularly confident about.

Pin bars work on all time frames but are especially powerful on the 1 hour, 4hour and daily chart time frames. It is possible to make consistent profits by only trading the pin bar formation.

Master just a few of our Forex strategies by practicing them on a Forex demo account from one of the best Forex brokers and you will be successful. Your Forex account will grow and you will earn a substantial income as long as you follow the winning Forex strategies correctly. These are some of the best Forex winning strategies on the internet.

Forex trading can be extremely rewarding to those traders who understand the Pin Bar Forex strategy and are able to make the right choices. Winning Forex soon becomes easier. In fact, by using Forex strategies it’s possible to increase one’s winning ratio and generate substantial profits. Elite Trading wishes you lots of success in your trading.