Forex Trading Basics

This page covers the fundamentals of Forex trading. You will learn a couple of different things. “What the heck is Forex Trading? How do I trade them and why would I want to?” In this article you will learn about the Forex trade. How they work, how to buy them, the benefits, and how easy it is for you to get started. Have no fear, even if you have no prior experience trading and aren’t some kind of Wall Street expert you can trade and profit from Forex Trading. Let’s get started.

What is the Forex market?

Foreign exchange (also known as forex or FX) refers to the global, over-the-counter market (OTC) where traders, investors, institutions and banks, exchange speculate on, buy and sell world currencies.

Trading is conducted over the ‘interbank market’, an online channel through which currencies are traded 24 hours a day, five days a week. Forex is one of the largest trading markets, with a global daily turnover estimated to exceed US$5 trillion.

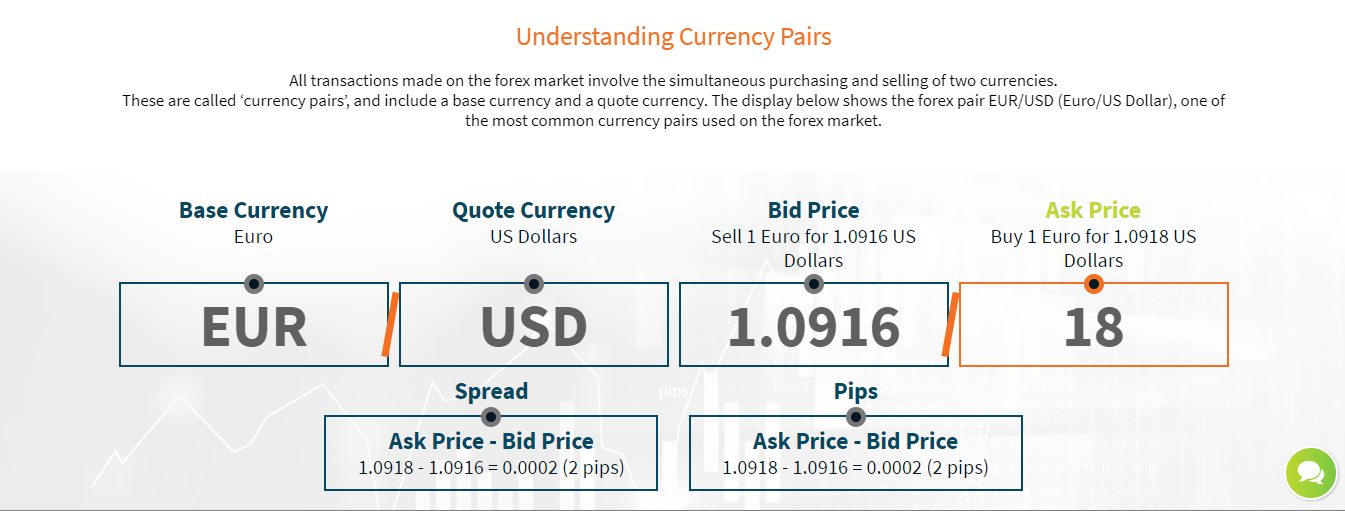

Understanding Currency Pairs

All transactions made on the forex market involve the simultaneous purchasing and selling of two currencies.

These are called ‘currency pairs’, and include a base currency and a quote currency. The display below shows the forex pair EUR/USD (Euro/US Dollar), one of the most common currency pairs used on the forex market.

PIPS

A pip is the unit of measurement to express the change in price between two currencies.

Just like a pip is the smallest part of a fruit, a pip in forex refers to the smallest price unit related to a currency. The term ‘pip’ is actually an acronym for ‘percentage in point’.

Professional forex traders often express their gains and losses in the number of pips their position rose or fell.

For example, if the EUR/USD moves from 1.2712 to 1.2713, that 0.0001 rise in the exchange rate is ONE PIP.

All major currency pairs go to the fourth decimal place to quantify a pip apart from the Japanese Yen which only goes to two.

Some brokers only quote to the fourth and second decimal place (for JPY pairs) but others, including AVA Trade, quote to the fifth decimal place of the currency to provide even greater accuracy when measuring gains and losses. This fifth decimal place is what we call a pipette – one tenth of a pip.

So for example if the EURUSD moves from 1.27128 to 1.27129, we can say it has moved one pipette or 0.1 pips (1 tenth of a pip).

CURRENCY TRADES

Trades & Key Terminology

A ‘position’ is the term used to describe a trade in progress. A long position means a trader has bought currency expecting the value to increase. Once the trader sells that currency back to the market (ideally for a higher price than he paid), his long position is said to be ‘closed’ and the trade is complete.

A short position refers to a trader who sells a currency expecting it to decrease, and plans to buy it back at a lower value. A short position is ‘closed’ once the trader buys back the asset (ideally for less than he sold it for).

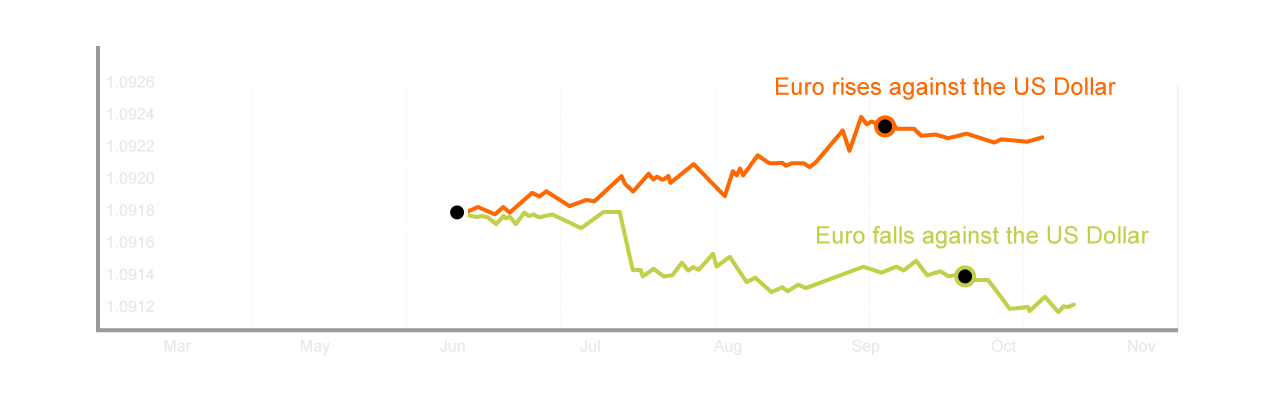

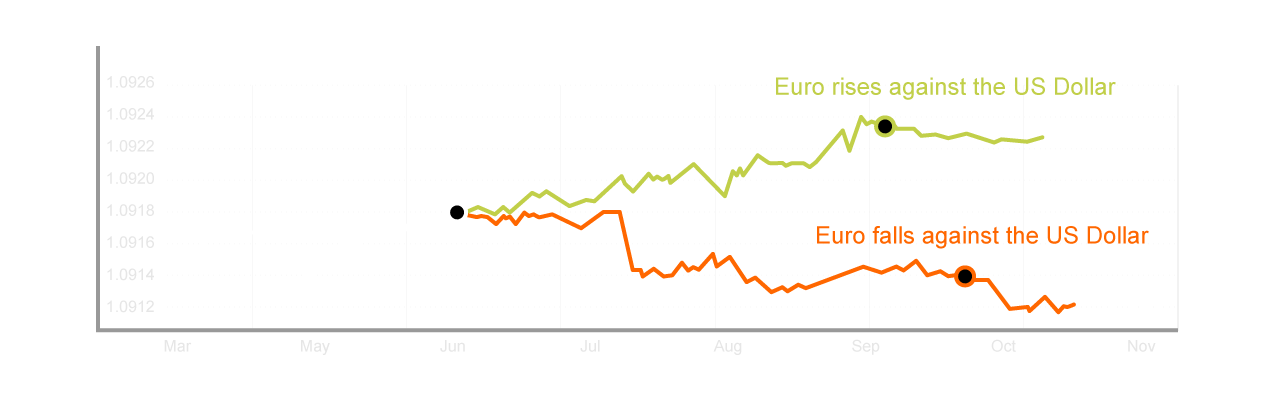

For example, if the currency pair EUR/USD was trading at 1.0916/1.0918, then an investor looking to open a long position on the euro would purchase 1 EUR for 1.0918 USD. The trader will then hold the euro in the hopes that it will appreciate, selling it back to the market at a profit once the price has increased.

An investor going short on EUR would sell 1 EUR for 1.0916 USD. This trader expects the euro to depreciate, and plans to buy it back at a lower rate if it does.

Below is an example of EUR/USD - Short Position

Below is an example of EUR/USD - Long Position

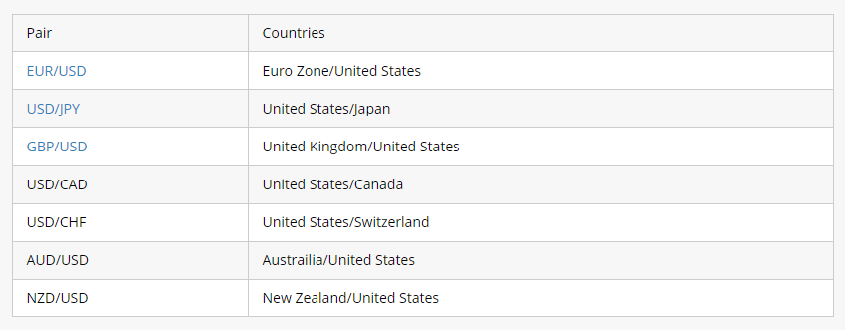

What are the most traded currency pairs on the Forex Market?

There are seven Major currency pairs on the forex market. Other brackets include Crosses and Exotic currency pairs, which are less commonly traded and all relatively illiquid (i.e., not easily exchanged for cash).

Major Pairs

Major pairs are the most commonly traded, and account for nearly 80% of trade volume on the forex market.

These currency pairs could typically have low volatility and high liquidity. They are associated with stable, well managed economies, are less susceptible to manipulation and have smaller spreads than other pairs. Major currency pairs all contain the US Dollar on one side – either on the base side or quote side. They are the most frequently traded pairs in the FOREX market. The majors generally have the lowest spread and are the most liquid. The EUR/USD is the most traded pair with a daily trade volume of nearly 30% of the entire FX market.

CROSSES

Cross currency pairs – Crosses – are pairs that do not include the USD.

Historically, Crosses were converted first into USD and then into the desired currency, but are now offered for direct exchange.

The most commonly traded are derived from Minor currency pairs (eg. EUR/GBP, EUR/JPY, GBP/JPY); they are typically less liquid and more volatile than Major currency pairs.

EXOTIC PAIRS

Exotics are currencies from emerging or smaller economies, paired with a Major. Compared to Crosses and Majors, Exotics are much riskier to trade because they are less liquid, more volatile, and more susceptible to manipulation. They also contain wider spreads, and are more sensitive to sudden shifts in political and financial developments.

Can Small / Medium Traders Actually Trade Forex?

“Wait a second – I can start out trading with as little as $100? I thought I had to be rich to trade.”

That is one of the beautiful things about the online Forex brokers. They have leveled the playing field for the retail, average trader who wants to risk a few hundred bucks and start out small. You can literally start out for as little as $100. However, it is advised to start out with around a $500 initial investment if you are new and just starting out. This gives you enough capital to trade small and learn to manage your trading bankroll. Being surprised that you can start with so little money is a common reaction to Forex trading among new traders who have never participated in any market before. “Retail trading” refers to individuals who trade for themselves to make money, rather than trading for a business or investment firm. Retail trading used to be very inaccessible, but since the advent of online technology, it has become a very common phenomena, and it is only continuing to grow.

So yes, you can get started with as little as $100 and no prior experience. If you understood the example above, you are theoretically ready to trade Forex. Can you trade them successfully, though? That is another question altogether. Forex traders usually fall under two categories: gamblers and serious traders. Which do you want to be? There is no “right” answer here. You may be interested in Forex trading for fun, or you may be hoping to trade for a living. What is most important is you know what you hope to get out of the market, and that you take a responsible approach to getting what you want.

Wait, is Forex Trading Just A Scam?

As far as the bigger threat to profitable trading goes, and that goes with your trading decisions, that is totally within your control. The only person who can make good or bad trading decisions is you, so if you want to maximize your gains and minimize your losses, it is important to do a lot more research and testing before you trade live. This is not as important if you are trading for fun and want to treat Forex trading like a slot machine. Even if you are trading for entertainment, though, you can choose to treat Forex trading like a game of poker and actually let your skill impact your gains.

In the our other articles, you read other information about Forex to help you get started. You will learn about the different types of Forex and how to choose a great broker. We are dedicated to helping you find the best websites for trading, the finest trading apps, and the best possible customer service so that you can embark as soon as possible on a profitable new career as a Forex trader!

Bankroll management

One of the most important things to learn in financial trading is to manage your bankroll. In this type of online trading you aren’t gambling and as such, you should always have a clearly defined strategy of how you’ll handle your money when you trade.

The first thing to remember is to decide in advance on a sum of money that you would like to invest. Under no circumstance should you go above this sum, even if you’ve lost everything (unlikely if you trade smart) or even if you have won all the contracts purchased.

Financial trading has to be emotionless. You’re there to make money. You’re doing business. Don’t get overexcited if you win because it can blind you and lead you to place not well thought out trades. Also, don’t get disappointed when you lose and run after your money. You may lose even more if you’re sad about losing.

Analyzing markets and news

Again we have to point out that Forex trading is not roulette. In roulette there are no ways whatsoever to increase your winning odds. However, in this type of financial betting you make your own success. – If you watch news, if you like business and if you’re smart, then you’re definitely able to generate consistent winnings in financial trading.

The best Forex winning strategies are build on knowledge. Watch the news, know what’s going on and you’ll be able to generate consistent profits. Almost every single major event that’s happening globally has an influence on markets.

You don’t even have to be an economist with a degree to see a connection between things. Everyone with some basic common sense can predict the movement of an asset. The secret is to pay attention to the signs.

Paying attention to major events

Microsoft is releasing a new product today at 10:00 AM? – Then make sure to place a very large bet on the fact that Microsoft’s stock prices will increase at 10:00. You can be 99,9999% sure that your prediction will turn out to be accurate and you’ll cash in a huge profit.

Sure, Microsoft may only release new products once or twice per year but most financial trading brokers offer the possibility to trade on the stocks of several dozen of companies. You just have to check when these companies release some new product… and bang, you can be sure you’ll win all your bets at least 95% of the time.

These things are also valid on other assets as well. Say, the US Federal Reserve announces that it has printed a large sum of money. Next thing to do is to place a bet that the USD will depreciate compared to other currencies such as EUR or GBP, and this is again a situation in which you’ll win 99% of the time.

Winning at Forex trading is really this easy. Seriously. – Most traders are just too lazy and believe that they don’t need to use Forex winning strategies to make money. These are the losing traders who make sure that the broker makes profits as well.

Do you want to be like them, or do you want to become a winner?

Master just a few of our Forex strategies by practicing them on a Forex demo account from one of the best Forex brokers and you will be successful. Your Forex account will grow and you will earn a substantial income as long as you follow the winning Forex strategies correctly. These are some of the best Forex winning strategies on the internet.