The Inside Bar Forex Strategy

What is an Inside Bar

As the name implies, an inside bar forms inside of a large candle called a mother bar. It’s a pattern that forms after a large move in the market and represents a period of consolidation. This is why trading this pattern can be so profitable – you are essentially buying or selling a breakout, or continuation of the preceding trend.

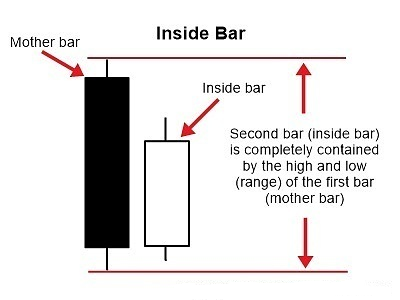

The illustration below shows the characteristics of an inside bar.

Notice how the second candle in the image above is completely engulfed, or contained, by the previous candle. In this case, the bearish candle (mother bar) represents a broader downtrend, while the bullish candle (inside bar) represents consolidation after the large decline. There are a few things you want to look for when evaluating any inside bar pattern.

1. Time Frame Matters

First and foremost, the time frame you use to trade inside bars is extremely important. As a general rule, any time frame less than the daily should be avoided with this strategy. This is because the lower time frames are influenced by “noise” and therefore produce false signals.

An inside bar that forms on the higher time frame has more “weight” simply because the pattern took more time to form. This means more traders were actively involved in its formation, which as a result equals higher capital flows.

2. The Trend is your Friend

Ah, the age-old saying – the trend is your friend. If you have been trading for any length of time I’m sure you have heard this one many times. As common as this saying may be, it has never lost its significance in the financial markets, especially when it comes to trading inside bars. In fact, trading with the trend is the best way to trade an inside bar setup.

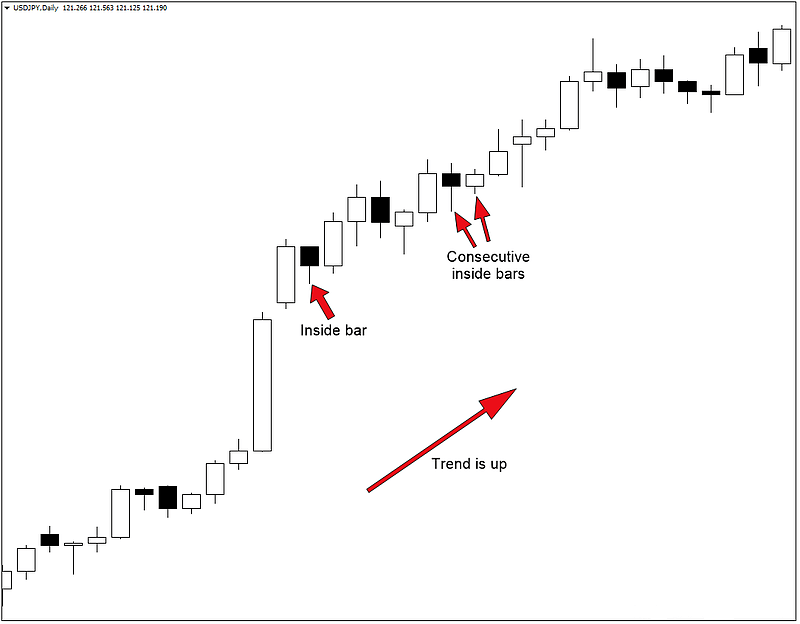

Below are two examples of inside bar patterns that formed in different market conditions. The first example is what you want to look for while the second is what you should avoid.

Inside bar setup with the trend (what to look for)

The bullish inside bar setups above formed on the USDJPY daily time frame. Note that this pair was in a strong uptrend leading up to both setups. This is the kind of momentum you want to look for when trading this strategy.

Inside bars in a choppy market (what to avoid)

The inside bars in the chart above formed on the GBPJPY daily chart in a choppy market. This sideways price action represents consolidation, which is what you want to avoid when evaluating an inside bar setup.

3. It's All About The Breakout

The best inside bar setups form just after a break of consolidation where the preceding trend is set to resume. The reason for this is quite simple…

A period of consolidation within a broader trend is the market’s way of regrouping. In an uptrend, the consolidation is triggered when longs decide to begin taking profits (selling). This causes the market to pullback, where new buyers step in and buy, which keeps prices elevated. This pattern continues for days, weeks or even months until new buyers are able to once again outweigh the sellers and drive the market higher.

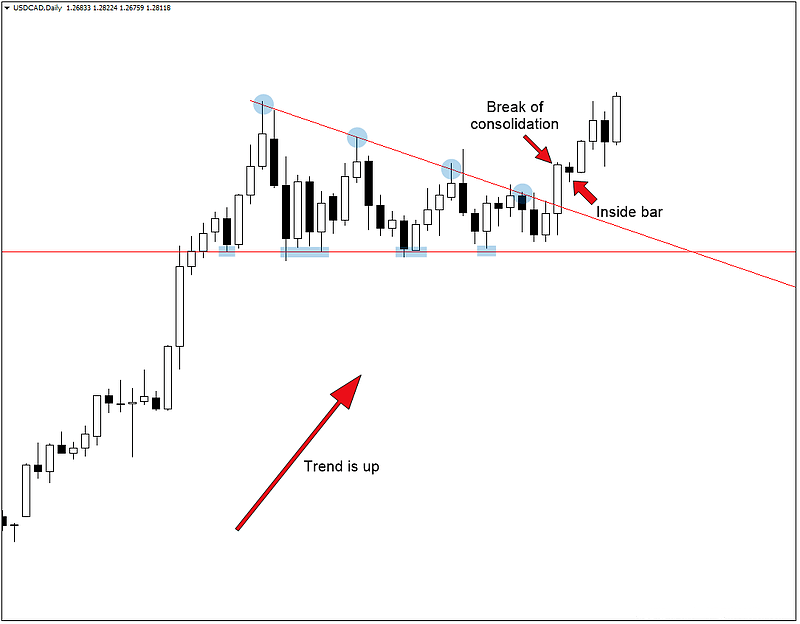

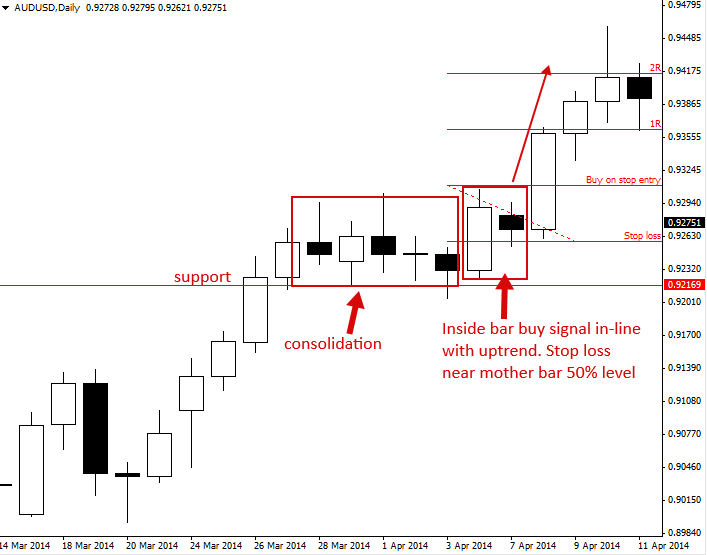

Below is a great example of a bullish inside bar that formed on the USDCAD daily time frame.

Notice how the bullish inside bar above formed after USDCAD broke out from multi-week consolidation. This period of consolidation allowed the market to “reset”, or shake out profit takers and attract new buyers for the next leg up.

This is the ideal scenario for trading a bullish inside bar setup as the market has gained a fresh set of buyers who are ready to push prices higher. Of course the opposite holds true for trading a bearish inside bar after a break of consolidation.

4. What's The Risk To Reward Ratio?

A favorable risk to reward ratio is needed for any setup to be taken by a forex trader who expects to profit in the long run. This is true whether we’re trading an inside bar, pin bar or other candlestick strategy. Each and every strategy needs to be accompanied by a favorable risk to reward ratio.

What is a favorable ratio, you ask?

It means always making sure your profit is 2 or more times your risk. So if your take profit is 100 pips, your stop loss can be no more than 50 pips away from your entry price. If using the more aggressive stop loss strategy, this means selecting inside bars that form near the upper or lower range of the mother bar. This allows you to achieve a much more favorable risk to reward ratio.

The two illustrations below explain this point further.

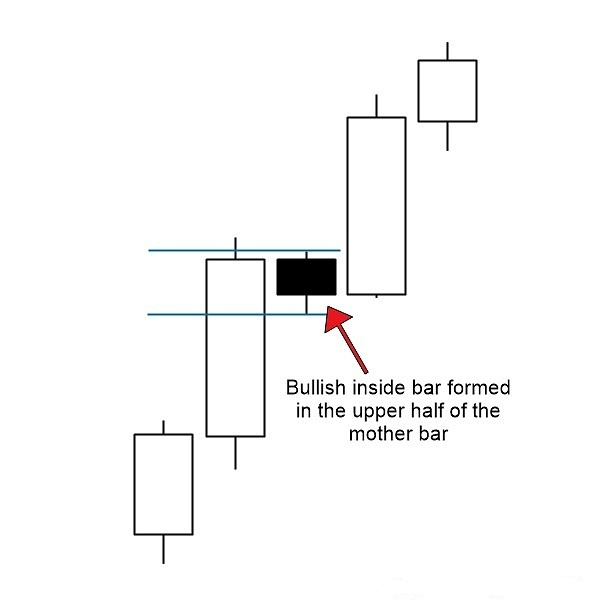

Bullish inside bar at the top of the range:

Notice how the bullish inside bar in the above illustration formed at the top of the mother bar’s range. This is what you want to see in a favorable setup, especially if you are using the more aggressive stop loss placement, which means placing your stop loss below the inside bar rather than the mother bar.

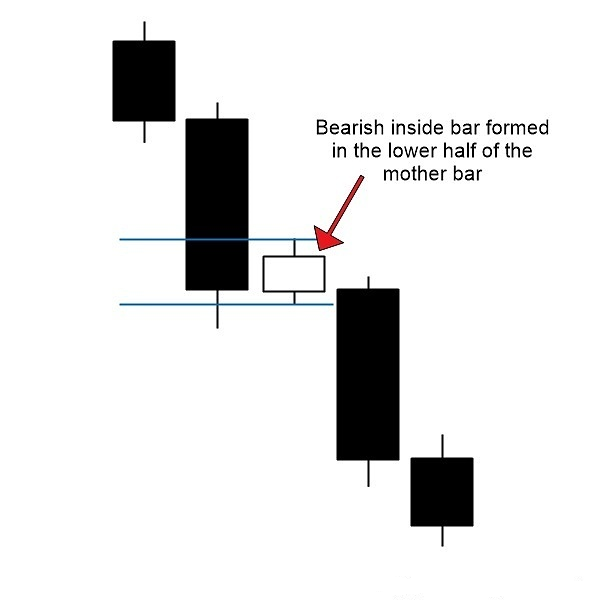

Bearish inside bar at the bottom of the range:

The same holds true for the bearish inside bar pictured above – the formation at the lower range of the mother bar is more favorable as it provides you with a better risk to reward ratio. Again, this assumes that you are placing your stop loss above the high of the inside bar rather than the high of the mother bar.

It is also correct to place your stop loss at the middle of the mother bar.

5. Size Matters

Last but not least, the size of the inside bar relative to the mother bar is extremely important. This idea piggybacks off of number four above, where the inside bar forms in the upper or lower range of the mother bar. In my experience, the smaller the inside bar is relative to the mother bar, the greater your chances are of experiencing a profitable trade setup. Ideally, we want to see the inside bar form within the upper or lower half of the mother bar.

Why is this?

Remember that an inside bar represents consolidation after a large move. This is what makes these patterns so lucrative – the fact that we are trading a breakout after a period of consolidation. Therefore the tighter this consolidation is, the more volatile the ensuing breakout will be. Of course, this isn’t always the case, but in my experience, it holds true more often than not.

What Doesn't Matter

What doesn’t matter when trading this particular pattern is whether the inside bar itself is bullish or bearish. In other words, if a market is in an uptrend and an inside bar forms inside of a large bullish candle, it doesn’t matter if that inside bar is bullish or bearish. The same holds true when trading a bearish pattern.

The only thing that matters is whether the mother bar is bullish or bearish. The formation of the mother bar, in combination with the trend, is what tells you which way to trade an inside bar setup.

Conclusion

There’s no doubt that inside bars can be a profitable way to trade the Forex market. However, it isn’t a setup that occurs often, at least not in a favorable context. It is, therefore, important to treat inside bars as another tool inside your trading toolbox rather than the toolbox itself.

The inside bar setup is capable of producing consistent profits, but only to the traders who mind the five characteristics discussed above. Watch the inside bar video for more information about the inside bar.

Master just a few of our Forex strategies by practicing them on a Forex demo account from one of the best Forex brokers and you will be successful. Your Forex account will grow and you will earn a substantial income as long as you follow the winning Forex strategies correctly. These are some of the best Forex winning strategies on the internet.

Forex trading can be extremely rewarding to those traders who understand the Engulfing Candlestick Forex strategy and are able to make the right choices. Winning Forex soon becomes easier. In fact, by using Forex strategies it’s possible to increase one’s winning ratio and generate substantial profits. Elite Trading wishes you lots of success in your trading.