MONEY MANAGEMENT

How to Use a Favorable Risk to Reward Ratio to Increase Trading Profits

Any efficient winning strategy in Forex must also contain money management. The money management part in Forex is not a strategy that will help you predict the movement of certain assets. It’s a strategy that will help you manage your assets well in order to achieve your desired profitability ratio.

Money management is generally ignored by lots of Forex traders. This is because they believe that it’s enough to be able to predict the movement of the market and everything else will follow automatically after this. However, if you don’t have the necessary discipline in order to manage your finances you might actually end up losing money rather than winning.

A good Forex money management strategy basically has two main parts, which are taking some risks as well as having the discipline to abide to the rules that you have proposed in your money management strategy.

Implementing a favorable risk to reward ratio single-handedly turned my trading around a few years ago. It made me realize that having a high win rate isn’t so important after all. In fact, it’s rather meaningless.

However, most Forex traders are so preoccupied with finding a profitable strategy that they forget about the importance of a favorable risk to reward ratio. As a result, they place more importance on a high win rate than on asymmetric returns. And I get it. I was one of those traders. But this is a mistake. It’s far easier to achieve a favorable profit to loss ratio than it is to win 80% or 90% of the time.

More importantly, trying to get your win rate that high is unnecessary.

As George Soros once said, “it’s not whether you’re right or wrong that’s important, it’s how much you make when you’re right and how much you lose when you’re wrong.”

That’s the essence of a favorable risk to reward ratio. You want to make sure that any trade setup you take is worth the risk. A great way to do that is with R-multiples. However, instead of just talking you through ratios, R-multiples and asymmetric rewards, I’m going to share four ways to maintain probable outcomes while using these techniques.

Read on to find out how I use a favorable risk to reward ratio in the Forex market to stack the odds in my favor.

R-Multiples Explained

Despite the intimidating name, the concept of R-multiples is quite simple yet highly effective. First off, the “R” stands for risk. The number we place in front of it is our multiple.

In its most basic form, the R-multiple is nothing more than a profit to loss ratio represented as a single number. The second point to understand is that your risk is always 1R. It doesn’t matter if you risk 1% of your account balance per trade or 5%, it’s always written as 1R.

Remember how I mentioned that the number we place in front of the R is the multiple? If I told you that I’m about to take a 3R setup on the EURUSD, it means my potential reward is three times my risk. Keep in mind that my risk, whatever it might be, is shown as 1R. Similarly, a 5R trade setup is one where the payoff is five times the amount risked.

Let’s take a look at a few examples.

- A setup with a 100 pip stop loss and a 200 pip target is a 2R setup

- A setup with a 100 pip stop loss and a 500 pip target is a 5R setup

- A setup with a 50 pip stop loss and a 300 pip target is a 6R setup

You get the idea. All we’re doing is dividing the distance to the target by the amount of pips we’re risking.

To bring things full circle, let’s take a look at a few examples that involve money.

- If a 1R loss is $100 and you make $200, you have a 2R profit

- If a 1R loss is $100 and you make $500, you have a 5R profit

- If a 1R loss is $50 and you make $300, you have a 6R profit

As you can see, the R-multiple concept is quite simple. It’s a great way to define risk because it pairs the potential loss with the payoff. By doing this, you can ensure that the setup you’re about to take is worth the risk.

Seeking Asymmetry

There’s a common misconception among Forex traders that trading risk is one dimensional. In other words, it’s defined as 1% or 2% of your account balance and that’s it. But those who think this way are missing the big picture.

Risk is never one dimensional. It has another facet that is often overlooked, and that’s where the concept of asymmetry really shines. What’s the missing dimension?

The potential reward of a given setup.

Forex risk is relative, both to the size of your trading account and to the profit you stand to make with any given position. A risk of 1% is meaningless without knowing your account size. It also tells me nothing about the profit you stand to make from risking 1% of your account.

The term asymmetry, or asymmetric, refers to the inequality between two sides. For traders, those two sides are risk and return.

An asymmetric trade is one in which the payout is significantly larger than the potential loss.I don’t know about you, but that definitely makes sense to me.

Would you rather risk the $10 in your pocket to make $30 or $5? I think we can all agree that risking $10 to make $30 is the sensible option. It’s also the one that has worked the best for me over the years.

Written as an R-multiple, that would be 3R.

Over the years, I’ve tried dozens of trading strategies. Some of them used an asymmetric risk to return, but most were the opposite. They involved a potential loss that far outweighed the profit.

This is often referred to as negative asymmetry or a negatively skewed risk to reward ratio. I’m sure you’ve experienced a similar situation, especially if you have used a scalping strategy.

However, starting a few years ago, I made asymmetry a requirement.

At first, I used a 2R minimum. So if I was risking 100 pips, the target needed to be at least 200 pips away from my entry.

It has worked so well that recently I increased my minimum from 2R to 3R. So when risking 100 pips, the target must be at least 300 pips away from the entry. Doing this will, of course, decrease the number of trades I take each month. After all, there are only so many opportunities that are 3R or greater, even when many different currency pairs.

While the frequency of trades might decrease, one thing that will surely increase is the average profit per trade.

Increasing my minimum R-multiple has also helped me stay more patient, which has ultimately led to better opportunities.

Combining Asymmetry With a Probable Outcome

Whenever I mention the idea of using an asymmetric profit to loss ratio such as 2:1 or 3:1, I inevitably get pushback from some traders. Some believe it isn’t practical. Their argument is that although your risk to reward becomes positively skewed, the odds of profiting decline.

There is some truth to that. An extreme example would be a 10R setup where the risk is 100 pips and the reward is 1,000 pips. Compare that to a setup where the profit target is just 100 pips from your entry. Which setup do you think stands a better chance of succeeding?

I think we can all agree that it’s the 1:1 risk to reward ratio.

However, in my opinion, traders who think this way are only viewing half of the equation.

Remember, trading isn’t about having a high win rate. You need to combine asymmetry with high probability setups if you really want to get ahead in this business.

Those who sell Forex trading robots will have you believe that a 90% win rate is required to get ahead. What they don’t tell you is that their trading robot risks 150 pips to make 10 pips or less. That’s a bad bet any way you look at it.

So how can you have a realistic expectation of a positive result while using an asymmetric risk to reward ratio?

Here are a few ways to do just that:

1. Know Your Key Levels

In order to achieve asymmetric returns, you must first identify key support and resistance levels. Without these areas, you won’t be able to determine your stop loss placement or profit target.

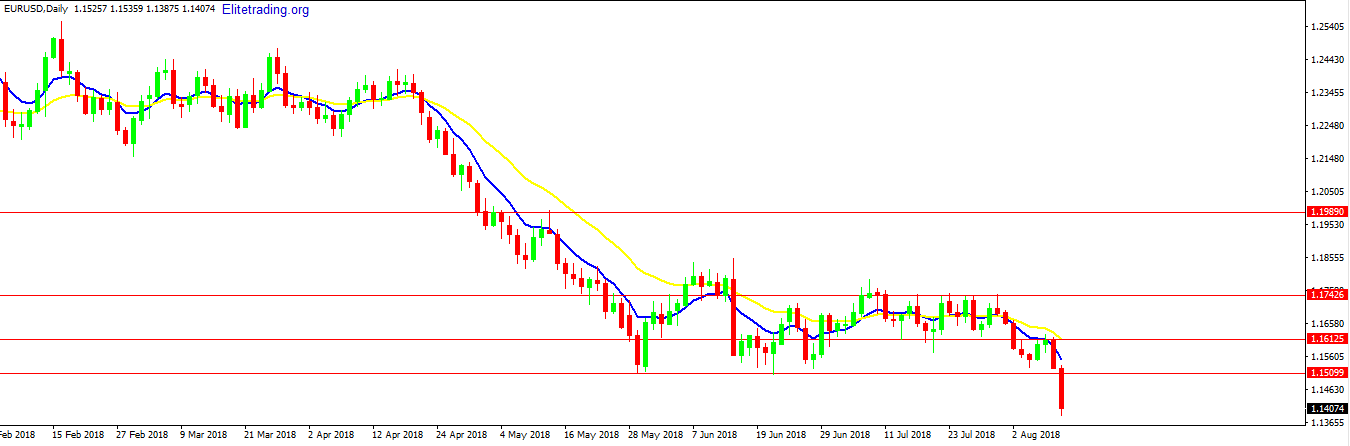

Take the chart below as an example.

A blank chart doesn’t do us much good. Not only are we unable to identify profitable opportunities, but we also can’t determine if the reward is worth the risk.

Once we plot our key horizontal levels, everything becomes clear. If we know the distance between each range, we can calculate the risk to reward for any setup that comes along.

These key areas are like the foundation of a house. They offer a stable starting point in terms of where to focus your attention, as well as where to place your orders.

You wouldn’t start building a house without a foundation, right?

Apart from learning to control your emotions, knowing how to draw support and resistance correctly is perhaps the most desirable trait of any trader. In fact, once you know how to plot these areas, everything else becomes rather effortless.

Think of it this way: if a bullish pin bar forms at critical support, the only way to know if a favorable profit to loss ratio is possible is to know the location of the next resistance level.

If the pin bar requires a 50 pip stop loss and the next resistance level is 100 pips away, you may have something worthwhile. On the other hand, if there’s 50 pips or less between the candlestick pattern on the next level, you should think twice about risking your capital.

See what I mean? Once support and resistance are in place, it’s simply a matter of asking yourself whether an asymmetric return is possible.

2. Evaluate Momentum

Want to know which side of the market the big banks and funds are on?

Sure you do. Luckily, determining where these institutions are positioned at any point in time is quite simple. All you need to do is evaluate the momentum. If the trend is pointing higher, it means most of the big players are buying the market.

Conversely, if the trend is heading lower, it means the banks and funds are likely selling the market. I know what you’re thinking. If it were that easy, we would all be on the “right” side of the market. But I never said it was easy. I said it’s simple. Those are two very different things.

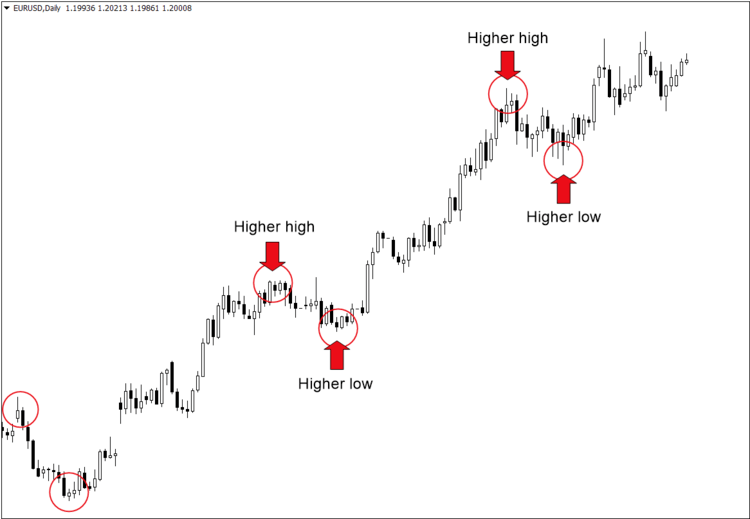

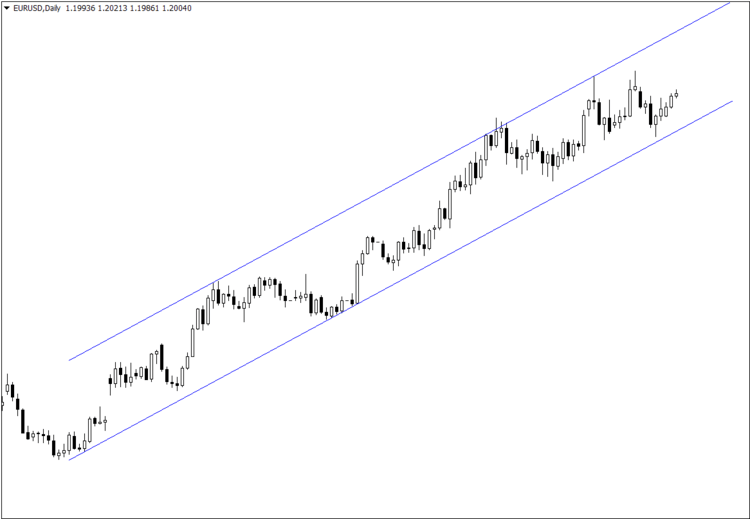

However, trend analysis doesn’t need to be difficult. It’s really just a matter of figuring out whether the market is creating higher highs and lows, or lower highs and lows.

All I did in the chart above was plot the swing lows and highs. As soon as I see this, it becomes obvious which side of the market I should be on. We can even take it one step further and plot an ascending channel.

Want to know when you should stop buying the EURUSD?

A close below that channel support is a good place to start. If the pair breaks that, there is a good chance the market will rotate lower.

That’s all there is to it. Once you know where the big boys are positioned, you can watch for opportunities in the same direction. By trading along with the momentum, your odds of achieving asymmetric profits such as 2R or 3R increases exponentially.

3. Use Measured Objectives

This is my favorite of the three. Measured objectives are perhaps one of the least used tactics in the world of trading. Most traders have heard of them, but few actually use them to their full advantage.

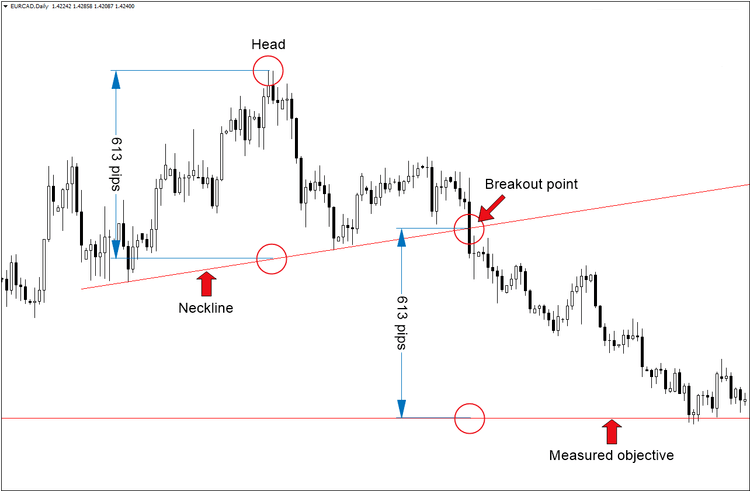

Put simply, measured objectives are a way to determine a market’s final target following the confirmation of a particular pattern.

I know that may sound confusing but it’s really very simple. For instance, there is only one way to determine the measured objective for a head and shoulders pattern. You measure from the neckline to the highest point of the head.

Here’s how it looks:

Notice how we first measured the distance from the neckline to the head. Once we have that measurement, we simply measure the same distance starting from the neckline to a lower point in the market.

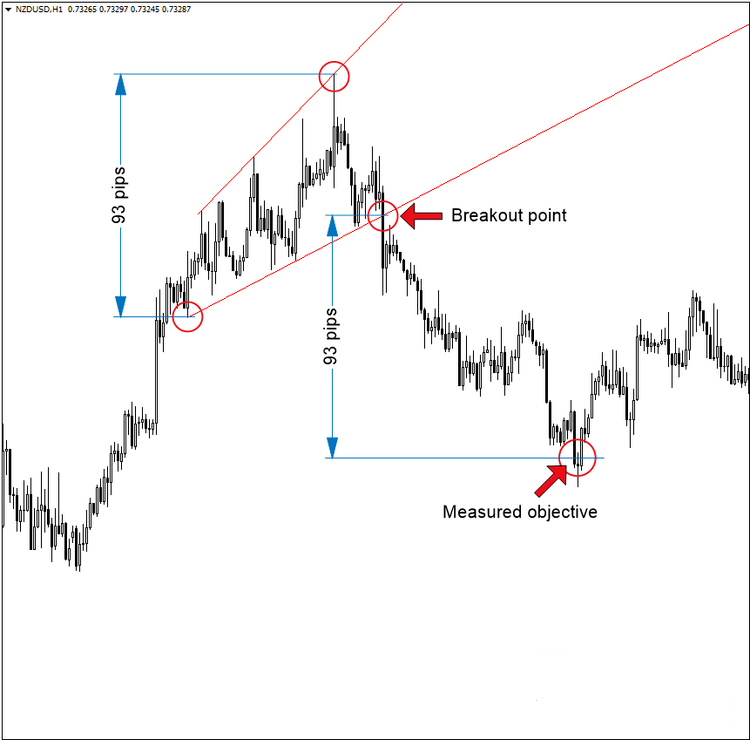

We can find a similar objective on a pattern such as the broadening wedge.

Notice how in this case, we measure the height of the broadening wedge and then use that same distance to identify a final target. You can see how objectives like these can help immensely when determining a final target. For instance, the head and shoulders pattern on the EURCAD in the chart above had a 613 pip target.

Even the broadening wedge on the NZDUSD 1-hour chart above had a 93 pip objective. The minor swing high that formed before the breakdown was about 20 pips away. If we divide 20 into 93 we get 4.65. That’s a 4.65R profit in a matter of just a few days. See how you can use these measured objectives to achieve a favorable Forex risk to reward ratio?

You won’t find price patterns like that often. That’s okay because when you know how to achieve asymmetric returns, you only need one per month to make considerable money.

Always Determine Exit Points in Advance

This one is non-negotiable. While you may be able to get away with not using a measured objective, you can’t ignore the importance of defining exit points beforehand. You can’t calculate risk accurately without knowing exactly where you intend to exit the market. That goes for your stop loss and your profit target.

Without knowing these levels, how can you determine your R-multiple? You can’t. Yet this is what many Forex traders do, and it’s one of the leading causes of emotional decision-making.

To calculate your R-multiple, you must first define your risk. Without it, you’ll have no idea what 1R represents. So before placing your next trade, make sure you have defined two exit points—one for where you will exit for a loss and the other is your profit target.

Start with the placement of the stop loss and then use the methods we just discussed to determine if an asymmetric risk to reward is possible. If so, further consideration is warranted. If not, it may be best to stay on the sideline.

Position sizing and the risk to reward ratio

It is absolutely paramount to your consistent profitability in the forex market that you understand the importance of the risk to reward ratio and how it relates to position sizing. Before entering any trade you need to know the exact dollar amount you want to risk and the exact reward you think you can make on the trade. At no point should you ever take a profit that is less than the amount you risked on the trade. Once you have determined the dollar amount you want to risk then you adjust your position size to meet this amount. If you are trading micro lots and want to risk $50 on a trade with a 100 pip stop loss then your position size will be .5 (remember 5 micro lots would be ½ of 1 mini-lot), .5 x 100 = $50. So you would have a position size of .5 mini lots (5 micro lots), risking $50 with a per pip value of .50 cents. There are many position size calculators to help you determine the lot size for your trade.

Conclusion

One reason many traders are against the idea of using an asymmetric risk to reward ratio is because it’s difficult to determine whether a market will reach its target. However, you never know what will happen next in any market. There are far too many variables to think you can predict what’s next with absolute certainty. That isn’t your job. Instead, a trader’s job is to determine what is likely. That’s all.

By using the methods we just discussed, it is possible to use a favorable profit to loss ratio and still have a realistic expectation of a positive result.

Just remember to draw your key levels, evaluate momentum and use measured objectives whenever possible.

Last but not least, always identify your exit points before entering the market. This will allow you to determine whether or not the setup is asymmetric and will also help to reduce emotional decision-making.

Master just a few of our Forex strategies by practicing them on a Forex demo account from one of the best Forex brokers and you will be successful. Your Forex account will grow and you will earn a substantial income as long as you follow the winning Forex strategies correctly. These are some of the best Forex winning strategies on the internet.

Forex trading can be extremely rewarding to those traders who understand the Money Management Forex strategy and are able to make the right choices. Winning Forex soon becomes easier. In fact, by using Forex strategies it’s possible to increase one’s winning ratio and generate substantial profits. Elite Trading wishes you lots of success in your trading.